Let’s talk about something that might sound a little scary but isn’t as intimidating as it seems: your credit score. You’ve probably heard the term thrown around before, but what is it really, and why should you care about it? As a financial expert, I know it can seem like a complicated mystery, but don’t worry—once you understand your credit score, you’ll see it’s just another part of your financial toolkit. And trust me, understanding it is key to unlocking financial freedom.

Think of your credit score like your financial reputation. It tells lenders (like banks, credit card companies, and landlords) how trustworthy you are when it comes to borrowing money. If you're good at managing money and paying off debt on time, you're considered a "low risk." If you're not great at keeping up with payments, you're seen as a "high risk." This is why your credit score is super important—it’s the key to unlocking loans, credit cards, rental apartments, and even job opportunities.

What Exactly Is a Credit Score?

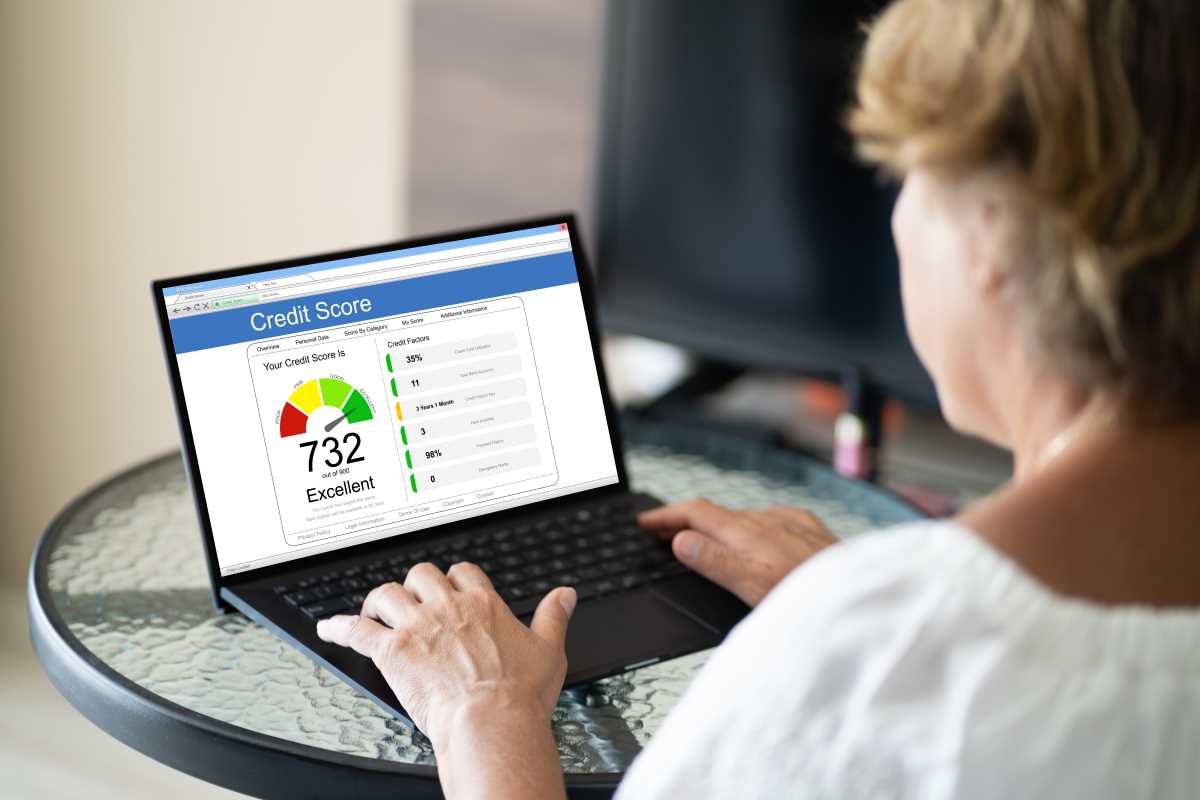

Your credit score is a three-digit number that ranges from 300 to 850, and it’s the most important number in your financial life. It’s a rating used by lenders to determine how likely you are to repay the money you borrow. Think of it as a report card for your finances, and just like a report card in school, the higher your score, the better.

Here’s a breakdown of the range of credit scores:

- 300-579: Poor. This means you might have trouble getting approved for credit cards or loans, and if you do, the interest rates will be very high.

- 580-669: Fair. You might be approved for credit, but with higher interest rates.

- 670-739: Good. You’re in a pretty good spot. You can get approved for loans and credit cards with decent interest rates.

- 740-799: Very good. You’ll likely get approved with low interest rates.

- 800-850: Excellent. This is the best possible range. Lenders will love you!

Why Does Your Credit Score Matter?

Now that you know what a credit score is, you might be wondering, “Why should I care about it?” The truth is, your credit score can impact many aspects of your financial life:

- Loans and Credit Cards: When you apply for a loan (like a car loan, mortgage, or personal loan) or a credit card, lenders use your credit score to decide if they should approve you. A higher score means you're more likely to get approved, and you’ll be offered better interest rates. A lower score may mean higher rates or even a denial.

- Interest Rates: The higher your score, the lower your interest rates. This is huge when it comes to saving money. Imagine borrowing $5,000 at an interest rate of 10% versus 20%. Over time, the 20% rate could cost you hundreds or even thousands more! So, a good credit score means saving money in the long run.

- Renting: Many landlords check your credit score to decide whether to rent to you. A good score shows you're responsible and are likely to pay your rent on time. A low score can make landlords hesitant to rent to you.

- Insurance Premiums: Some insurance companies use your credit score to determine your premiums. A higher score may result in lower premiums, saving you money.

- Jobs: Some employers check your credit score during the hiring process, especially for jobs that involve managing money. They see a good score as a sign that you're trustworthy and responsible.

What Makes Up Your Credit Score?

Your credit score isn’t just one thing—it’s made up of several factors. Let’s break them down so you know what really impacts your score:

- Payment History (35%): This is the biggest factor. It shows whether you pay your bills on time. Late payments, bankruptcies, or any financial struggles can seriously hurt your score. The more on-time payments you make, the better your score will be.

- Amounts Owed (30%): This factor looks at how much debt you have compared to your credit limits. It’s often called your “credit utilization ratio.” If you’re using too much of your available credit, it can lower your score. Ideally, you want to use less than 30% of your credit limit. For example, if your credit card limit is $1,000, try to keep your balance below $300.

- Length of Credit History (15%): The longer you’ve had credit, the better. Lenders like to see that you’ve managed credit over time. If you’re just starting out, don’t worry too much about this—it will grow as you keep using credit responsibly.

- New Credit (10%): If you’re opening a lot of new credit accounts in a short period, it can negatively impact your score. Every time you apply for credit, it triggers a “hard inquiry” on your report, which can cause a temporary dip in your score. So, only open new accounts when you really need to.

- Credit Mix (10%): This looks at the different types of credit you have, like credit cards, auto loans, mortgages, or student loans. Having a mix of different types of credit can be beneficial, but you don’t need to go out of your way to get a variety. Just be mindful of how you manage each type.

How to Build a Good Credit Score (Even If You’re Starting from Scratch)

Building a good credit score takes time, but it’s totally doable! Here’s how to get started:

- Pay Your Bills on Time: This is the most important thing you can do for your score. Set up automatic payments for your bills or use reminders so you never miss a due date. Late payments can seriously damage your score.

- Keep Credit Card Balances Low: Aim to use less than 30% of your credit limit. If you can pay off your credit card in full each month, that’s even better. Keeping balances low shows you can handle credit responsibly.

- Don’t Open Too Many New Accounts: Each time you open a new account, it can temporarily hurt your score. Be cautious about opening new accounts, especially if you're trying to build your score.

- Check Your Credit Report Regularly: You’re entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Review your reports for any errors or inaccuracies. If you spot something wrong, dispute it right away.

- Consider a Secured Credit Card: If you're new to credit or have bad credit, a secured credit card can help you get started. With a secured card, you make a deposit that becomes your credit limit. Use the card responsibly, and your score will improve over time.

- Become an Authorized User: If someone you trust has a credit card with a good payment history, ask them to add you as an authorized user. This can help you build credit without having to open a new account.